Millennials and other first-time buyers might need to adjust their thinking to some degree when considering buying that first home. While 40% of home purchased in the High Country are done so with cash, most people under 30 years old are not walking around with $300,000-$500,000 ready to plop down on a home – unless you’re lucky enough to win the NC Education Lottery. (At the time of this writing, the jackpot was at $747,000,000!)

So what are we to do?

A quote from BusinessInsider.com:

The government-sponsored enterprise said that the average 30-year fixed-rate mortgage inched lower to 6.09% on Thursday, notching its fourth-straight week of declines. That’s the lowest rates have been since peaking at over 7% in November of last year, Freddie Mac chief economist Sam Khater said in a statement.

“This one percentage point reduction in rates can allow as many as three million more mortgage-ready consumers to qualify and afford a $400,000 loan, which is the median home price,” Khater added.

Other areas of the housing market are also showing signs of picking back up. Home builder sentiment is rising, and lumber prices have jumped 33% since the start of the year as buyers dip back into the housing market.

Let me tell you a story:

This news was met with excitement and relief. People who had been struggling to save for a down payment suddenly found themselves with a little extra cash in their pockets. Potential homebuyers could now afford to take out loans with lower monthly payments, making homeownership a realistic possibility.

Real estate agents and brokers were inundated with calls from eager buyers. The demand for homes skyrocketed and the market became more competitive. Sellers who had been waiting for the right time to put their homes on the market saw an opportunity to capitalize on the newfound demand.

As more homes were sold, the construction industry also saw a boost. Builders were able to break ground on new developments, creating jobs and breathing life back into the economy. The town was buzzing with excitement and optimism.

People who had been priced out of the market just a few months prior were now able to purchase their dream homes. Young couples starting families could finally have a place to call their own.

The drop in interest rates created a ripple effect throughout the city, touching the lives of many and revitalizing the housing market. And as the city continued to grow and prosper, the residents looked back on that moment with gratitude, knowing that the drop in interest rates was a turning point for them and their community.

You can take “Boone” out of this story and replace it with most any town or city in the United States.

You Can Also Replace 2023 with Numerous Other Years In Our Past

Our parents and grandparents went through many periods. In the mid-seventies and by 1981 30-year fixed-rate mortgages hovered between 7.29% and 7.73%. Inflation began spiking in the late 70s and continued to rise into the 1980s. Rates crossed into double-digit territory going to 10.11% at the end of 1978 and rising to 12.90% by the end of the 70s.

Certainly, less people were able to buy homes during those times and especially so when mortgage rates climbed to an all-time high of 18.45% in 1981. However, anytime mortgage rates DIPPED back down to 10% and below, people found a way to achieve their dreams of homeownership.

To be clear, when mortgage rates make the monthly payment so high that it eats up a lot of your monthly income, your homeownership dream might not need to be that “forever home” of $500,000 that you’ll probably be able to afford later in life. However, just like our very intelligent parents and grandparents did, we can tighten our budgets elsewhere to make room in the financial strategy of buying and owning a home.

To afford that higher, monthly home payment, you might not be able to eat out three nights a week or take two-week long, dream vacations, but that’s what we did back in the 1970s, 1980s, 1990s and that’s what we’ll need to do now.

How Much Home Can You Really Afford?

According to census.gov, the median household income in North Carolina during 2017-2021 was $60,516. The rule of thumb for homeownership and the mortgage payment that goes with it is that you should spend only about 30% of your income on housing cost – mortgage payment, property taxes, homeowners insurance and maintenance.

A simple mortgage calculator search and some “backward engineering” will tell you that the average, median household in North Carolina should be buying a home in the $250k range. (Can I get a hearty “Amen” from you parents and grandparents?)

I can hear them now. My parents would be saying, “These young people; they want it all now and they can’t afford it yet.”

Our parents and grandparents were/are pretty smart.

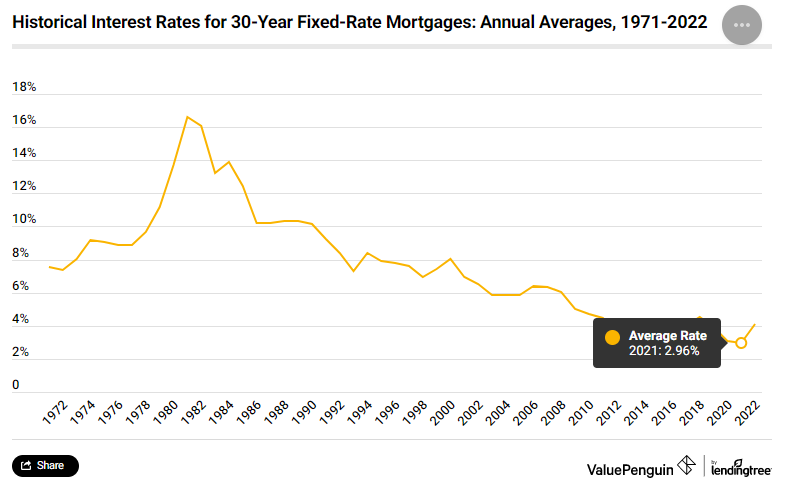

Check Out These Historical Mortgage Rates from 1971 to 2022

It Wasn’t THAT Long Ago That 6% was a Decent Mortgage Rate

Check out this graphic below (courtesy of ValuePenguin and LendingTree):

Note that mortgage rates didn’t get below 6% until after the 2008 housing crash.

I was chatting with some old-timers recently who shared that mortgage rates should never be THE ONLY thing that drives your decision into buying a home. Of course, my grandfather once told me that he paid $6,000 for their first house. I can barely find an old Chevy under 20 years old for that!

“The No. 1 thing for buyers to make sure [of] is that the monthly payment is comfortable and fits their budget,” – said every grandfather.

If YOU are a first-time buyer and looking to make homeownership a reality, call Madi at 828.616.6044

Ready to View Some Boone NC Homes for Sale